Investment Thesis

IronCrest Equity Investment Thesis

At Ironcrest Equity, we invest in proven, profitable businesses that are at an inflection point — stable but stuck — and ready to scale. We target companies in the $5M–$50M lower middle market with a track record of strong operations but limited growth due to leadership fatigue, lack of innovation, or outdated systems.

- Our thesis centers on buying bold and scaling SMART by integrating

- AI and GenTech tools to optimize performance, operations, and decision-making

- Strategic M&A for vertical or horizontal expansion

- Real estate development as a parallel value driver through acquisition, renovation,and exits

We believe in creating enterprise value by combining operational excellence with visionary growth strategies — and designing 3–5 year exit plans that deliver premium returns for our investors while making a measurable impact on the communities we touch.

- Deal Types: Strategic buyouts, vertical integration, co-syndication, and founder transitions.

- Target Companies: Founder-led or distressed businesses with high-growth potential, in the $5–$50M lower middle market range, that serve essential community needs.

- Value Creation Strategy: We streamline operations, integrate service lines, build strategic partnerships, and bring in leadership support to scale impact and profitability.

IronCrest Equity Visual Investment Thesis

Our Core Investment Focus

Iron Crest Equity invests in overlooked opportunities where profit meets purpose, delivering outsized returns while building community wealth and sustainable ecosystems.

Workforce-Aligned Real Estate

- Value-add multifamily and transitional housing

- Workforce housing in emerging and opportunity zone markets

- Real estate co-located with health and workforce services

Healthcare + Behavioral Health Services

- Mental health & therapy clinics

- Substance abuse treatment centers

- Healthcare staffing and in-home care services

- Facilities with real estate synergy

Education & Workforce Innovation

- Trade schools, certification programs, and edtech

- AI and future-of-work platforms

- Workforce training hubs aligned with our SMART Innovation Center

Vertical Integration (via M&A)

- Acquisitions that reduce third-party reliance (e.g., billing, therapy, training)

- Streamlined ecosystems across our portfolio assets

- Operational efficiency + increased internal revenue control

Legacy Business Acquisitions

- Companies with 7+ years of history or retiring baby boomer owners

- Founder-led businesses ready for succession

- Strong cash flow with limited institutional presence

- Targets across logistics, trades, childcare, local services

Tech-Enabled Service Businesses

- SaaS or platform-based B2B service providers

- AI-enhanced operations (automation, analytics, integrations)

- Recurring revenue, low-churn businesses

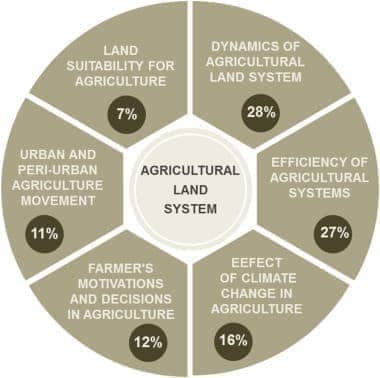

Agriculture, Food Systems & Land Use

- Urban and regenerative agriculture

- Food access + distribution ventures

- Land with development or community utility value

Our Differentiator: Purpose-Driven Private Equity

We operate with the agility of a boutique firm and the vision of an institutional partner. Each investment is designed to be:

- Scalable and self-sustaining

- Community-embedded

- Operationally enhanced through vertical integration

Our thesis blends social impact, capital efficiency, and founder succession into a repeatable framework for growth.